The quiet advertising story on YouTube right now isn’t about pre-rolls; it’s sponsorships. Not as one off brand deals with large creators but as a real, scalable, advertising medium.

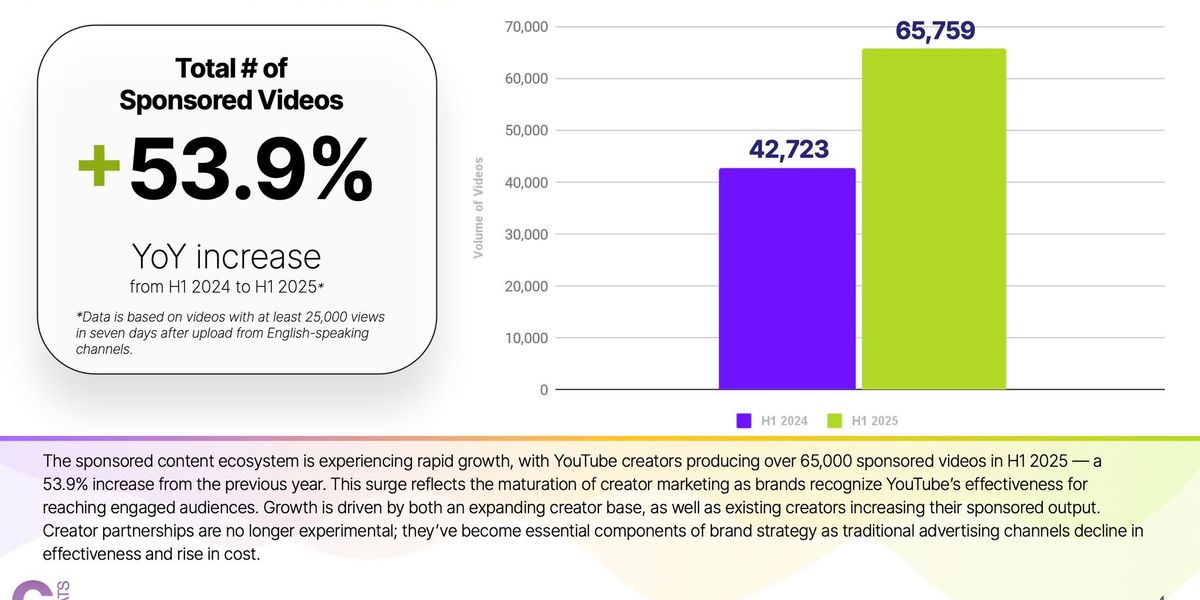

Gospel Stats’ new YouTube Sponsorship Landscape Report puts numbers to what teams have been feeling in the weekly standup: 65,759 sponsored videos in H1 2025—up 53.9% YoY—driving 19.1B views (+27.9% YoY). The growth is mid-tier led (think creators reliably pulling 100K–500K views per video), which means this isn’t a lottery powered by one or two viral hits. It’s distribution you can plan around. Ground News vaulted to the #1 sponsor with 1,862 integrations (+202% YoY). Shopify spread spend across hundreds of creators to keep frequency high without burning out audiences.

“On YouTube, sponsorships aren’t just impressions,” said Nick Cicero, Mondo Metrics Founder & CEO. “Brands are choosing to live inside a creator’s world—turning frequency into cultural relevance, authenticity layered on top of reach. Sponsorships are how brands turn ad frequency into cultural frequency. On TV, you could only buy more spots. On YouTube, you can buy more creators—and that scales authenticity in a way old media never could.”

The trend is real and YouTube is on board.

A year ago, scaling sponsorships meant juggling bespoke deals and hoping contracts lined up. Today, the mechanics look a lot more like media.

In September, YouTube unveiled a set of creator-brand tools that quietly change the operations math: dynamic “swappable” sponsor slots in long-form videos (so creators can insert or replace brand segments over time), AI-powered product tagging with auto-timestamps (so shoppable context appears exactly when interest spikes), and brand links in Shorts with shareable performance insights in Studio. These tools have supercharged

YouTube also put receipts behind commerce momentum: Shopping GMV up 5× YoY with 500,000+ creators enrolled as of July 2025. In this new world sponsorships build the context; and Shopping converts that intent in-stream.

Why it’s happening

1) Infrastructure finally caught up to behavior. The early influencer era forced brands to hand-craft a few giant bets. Now, marketplaces, affiliate rails, and platform-native outreach tools make it practical to buy more creators instead of more impressions with the same creators. That spreads risk, increases learning velocity, and keeps the creative grammar native to each subculture.

2) Creators turned pro. More creators are prospecting, packaging, and optimizing like performance marketers—often designing content around conversion mechanics, not just awareness. The Gospel Stats growth curve is the macro view of that micro professionalism.

3) The product roadmap favors native integrations. Swappable slots convert old uploads into living inventory. AI tagging reduces the tagging grind and improves timing. Brand links in Shorts turn a punchy clip into a measurable path. Add it up and you get sponsorships that behave like programmable media—without losing the cultural fit that made creator content valuable in the first place.

What it means

Wall Street will keep tallying ads that pass through Google’s exchange. Meanwhile, a parallel market is compounding outside those reported revenues: sponsorship budgets flowing into creator ecosystems where brands don’t interrupt the content—they live inside it.

The takeaway from the data (and what we see on the ground) is simple: scalable sponsored video isn’t theoretical anymore. It’s an operating reality with real volume (65K+ integrations in Q1 2025 alone), real outcomes (19.1B views on sponsored content), and a product roadmap that’s removing the last bits of friction.